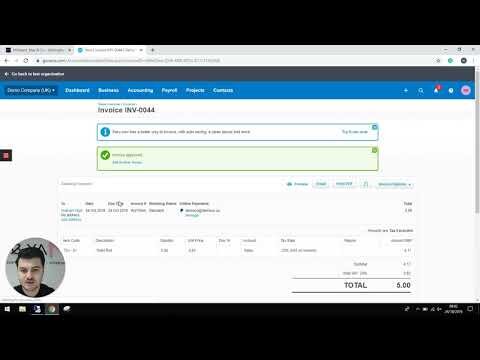

And if we look at the spend management process specifically, AI can be used to detect fraudulent invoices, duplicate payments, and expenses that breaching company policies. NLP or natural language processing is the branch of AI that gives computers the ability to understand text and spoken words in much the same way human beings can. By working with supplier-specific models, Yokoy’s AI-engine is able to process invoices with much higher accuracy rates than other invoice automation apps on the market. When an invoice is uploaded into the tool, the AI model analyzes line items submitted by that particular supplier, and looks for associations between keywords and selected line items.

With Receipt-AI, you can save up to 97% of the time spent on uploading receipts to accounting software like Xero and .. Morphlin is a powerful AI-based trading tool that empowers traders to make informed investment decisions and trade wisely. While ML algorithms are dealing with a myriad of tasks, they are constantly learning from the volumes of data, and bridging the gap by bringing the world closer to a completely automated financial system. Taking the security a notch higher, machine learning applications will transform future security within the industry with adoption of voice recognition, facial recognition, or other similar biometric data.

Paymefi is an AI-powered debt collection tool that helps recover money faster and at a lower cost. It offers a one-click payment solution to facilitate debt collection Prepare Deferred Revenue Journal Entries and decrease recovery time by up.. It allows users to retrieve precise information from SEC filings using AI, eliminating the need for manual data crunching.

One financial application is to train an agent to hedge a European call option contract and save on transaction costs. Deep learning, a subset of machine learning, utilizes neural networks and is applied to machine learning problems simultaneously perform feature extraction and prediction within the neural network architecture. This approach eliminates the need to perform feature extraction prior to developing a predictive model. Moreover, deep learning requires a substantial historical training data set to build a robust and accurate predictive model.

Developed economies have regulations in place to ensure that specific types of data are not being used in the credit risk analysis (e.g. US regulation around race data or zip code data, protected category data in the United Kingdom). Regulation promoting anti-discrimination principles, such as the US fair lending laws, exists in many jurisdictions, and regulators are globally considering the risk of potential bias and discrimination risk that AI/ML and algorithms can pose (White & Case, 2017[22]). AI can help companies drive accountability transparency and meet their governance and regulatory obligations.

The increasing use of complex AI-based techniques and ML models will warrant the adjustment, and possible upgrade, of existing governance and oversight arrangements to accommodate for the complexities of AI techniques. Explicit governance frameworks that designate clear lines of responsibility for the development and overseeing of AI-based systems throughout their lifecycle, from development to deployment, will further strengthen existing arrangements for operations related to AI. Internal governance frameworks could include minimum standards or best practice guidelines and approaches for the implementation of such guidelines (Bank of England and FCA, 2020[44]). Synthetic datasets generated to train the models could going forward incorporate tail events of the same nature, in addition to data from the COVID-19 period, with a view to retrain and redeploy redundant models.

Most importantly, each document produced by Rebank is fully compliant with the legal requirements of the countries involved, providing a solid legal foundation for the transactions. Their easy to use dashboard is meant for anyone to be able to contribute to, while still offering advanced capabilities that enable technical teams to respond quickly to business needs. Here are a few examples of companies using AI and blockchain to raise capital, manage crypto and more. A Vectra case study provides an overview of its work to help a prominent healthcare group prevent security attacks. Vectra’s platform identified behavior resembling an attacker probing the footprint for weaknesses and disabled the attack. The market value of AI in finance was estimated to be $9.45 billion in 2021 and is expected to grow 16.5 percent by 2030.

While this kind of specialized chatbot experience is not the norm today in the banking or finance industry, it holds great potential for the future. This is one application that goes beyond just machine learning in finance and is likely to be seen in a variety of other fields and industries. Because human factors primarily drive the stock market, businesses need to learn from the financial activity of users continuously. Further, consumer sentiment analysis can also complement current information on different types of commercial and economic developments. An excellent example of this could be machine learning algorithms used for analyzing the influence of market developments and specific financial trends from the financial data of the customers.

At the single trader level, the lack of explainability of ML models used to devise trading strategies makes it difficult to understand what drives the decision and adjust the strategy as needed in times of poor performance. Given that AI-based models do not follow linear processes (input A caused trading strategy B to be executed) which can be traced and interpreted, users cannot decompose the decision/model output into its underlying drivers to adjust or correct it. That said, there is no formal requirement for explainability for human-initiated trading strategies, although the rational underpinning these can be easily expressed by the trader involved. The most disruptive potential of AI in trading comes from the use of AI techniques such as evolutionary computation, deep learning and probabilistic logic for the identification of trading strategies and their automated execution without human intervention. Contrary to systematic trading, reinforcement learning allows the model to adjust to changing market conditions, when traditional systematic strategies would take longer to adjust parameters due to the heavy human involvement. Artificial intelligence has streamlined programs and procedures, automated routine tasks, improved the customer service experience and helped businesses with their bottom line.

That said, some AI use-cases are proving helpful in augmenting smart contract capabilities, particularly when it comes to risk management and the identification of flaws in the code of the smart contract. AI techniques such as NLP12 are already being tested for use in the analysis of patterns in smart contract execution so as to detect fraudulent activity and enhance the security of the network. Importantly, AI can test the code in ways that human code reviewers cannot, both in terms of speed and in terms of level of detail.

By gaining insights into customers’ emotions and opinions, companies can devise strategies to enhance their services or products based on these findings. Specialized transformer models help finance units in automating functions such as auditing, accounts payable including invoice capture and processing. With deep learning functions, GPT models specialized in accounting can achieve high rates of automation in most accounting tasks. Senex Intelligent Chain is an AI-powered blockchain platform that combines artificial intelligence and blockchain technology to enable secure and private data processing. And this practice spread to most—if not all—corners of finance, from insurance providers to fraud detection to market analysis and trading. Even now, Krubiner told Fortune, complex regression models form the backbone of finance.

Olli is an enterprise AI tool that generates custom dashboards and insights 10x faster. It allows everyone to generate answers to ad-hoc questions and make better decisions faster. Real-time Financial Intelligence,Automatically analyze real-time financial intelligence from different sources like twitter, reddit, news and blog posts to understand the market and gain market insigh.. AlphaResearch helps investors extract information from unstructured texts, filings, earnings call transcripts, and much more to help with investing decisions and analysis of stocks and companies finan.. Zoom is a virtual communication platform that offers a variety of tools for teams to collaborate and connect remotely.

In fact, a recent survey by the Association of Certified Fraud Examiners found that organizations lose an estimated 5% of their revenue to fraud each year, with expense reimbursement fraud being one of the most common types of fraud. For example, with Yokoy, detecting duplicate payments is fully automated and is a matter of seconds, no human input being required. Finance AI technology can be used to automate approval flows for both expenses and invoices, based on pre-set rules, such as suppliers, categories, or spending limits. This ensures that payments and reimbursements are approved quickly and efficiently.

Kasisto is the creator of KAI, a conversational AI platform used to improve customer experiences in the finance industry. KAI helps banks reduce call center volume by providing customers with self-service options and solutions. Additionally, the AI-powered chatbots also give users calculated recommendations and help with other daily financial decisions.

Distributed ledger technologies (DLT) are increasingly being used in finance, supported by their purported benefits of speed, efficiency and transparency, driven by automation and disintermediation (OECD, 2020[25]). Major applications of DLTs in financial services include issuance and post-trade/clearing and settlement of securities; payments; central bank digital currencies and fiat-backed stablecoins; and the tokenisation of assets more broadly. Merging AI models, criticised for their opaque and ‘black box’ nature, with blockchain technologies, known for their transparency, sounds counter-intuitive in the first instance. Similar to all models using data, the risk of ‘garbage in, garbage out’ exists in ML-based models for risk scoring.

Input your search keywords and press Enter.